This post is part of the MNTO Gigs initiative, where contributors earn for their ideas. If you have an article idea, we'd love to hear from you! Submit your pitch here.

Development Charges 101

By Damien Moule X:@damienmoule

Today, we take a look at Development Charges. In Toronto, you will often hear a councillor or city staff member utter the phrase “growth pays for growth”. When they say that, they are usually referring to Development Charges. This article goes through the basics of Development Charges: what are they, how they work, and what impact they have on housing.

What are Development Charges?

Development Charges are fees raised by municipalities and school boards on new housing development. They are raised for the purpose of paying for new infrastructure required as a result of the new development.

In Ontario, the rules and regulations for Development Charges are outlined in the Development Charges Act and Regulation 20/98 under the Education Act. For the City of Toronto, they are implemented through Bylaw 1137-2022, and are helpfully summarized on the City’s website. For the Toronto Catholic District School Board, they are implemented through Bylaw 2023 No. 195. Similar fees are raised in multiple provinces in Canada, as well as other jurisdictions around the world.

How Much are Toronto’s Development Charges?

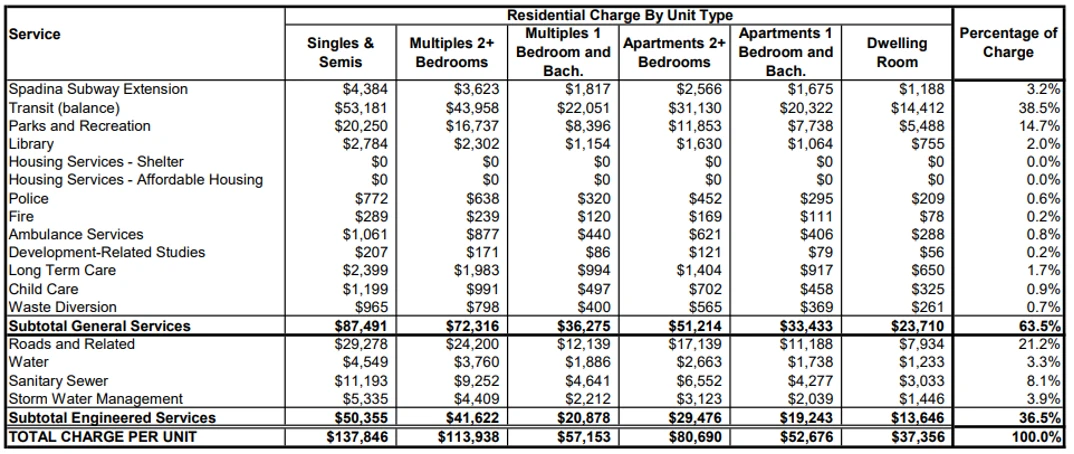

The City raises two types of development charges. The first and largest are the base Development Charges. The City collects different amounts of Development Charges for each of the following categories: residential non-rental, residential rental, non-residential. It has also set separate rates for buildings in inclusionary zoning areas, but inclusionary zoning is not currently in effect in Toronto. The 2024 rates for residential non-rental are shown in the table below. The rates are a significant fraction of the cost of new housing, in the range of 10% of average sale prices for new apartments.

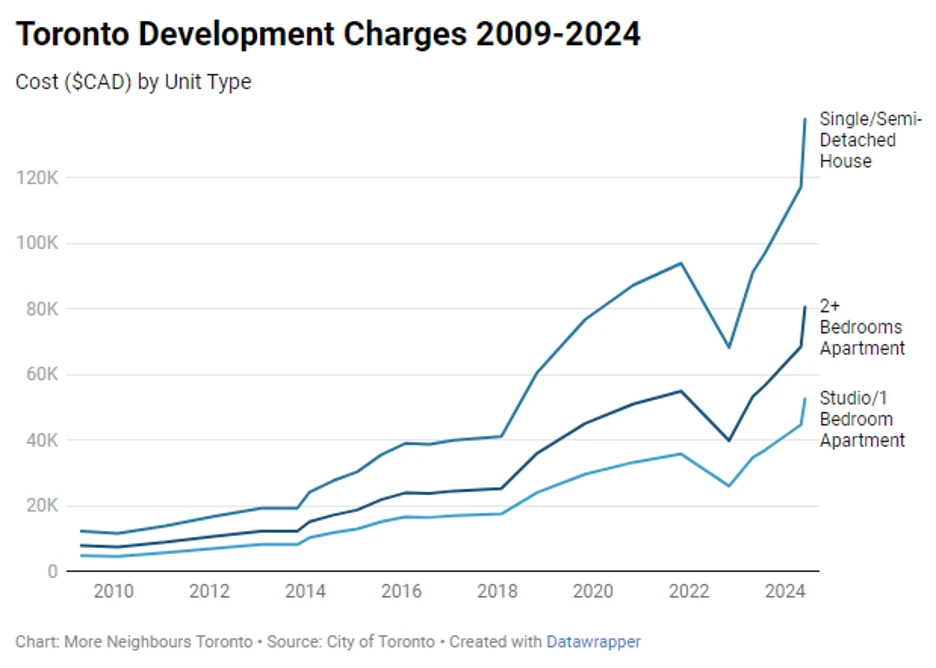

Development Charges have not always been this high in Toronto. They have increased rapidly over the past 15 years. The chart below shows the Development Charges raised on non-rental residential units from 2009 to 2024. In that time, the charge on a non-rental one bedroom apartment has gone from $4,985 to $52,676, an average annual increase of 17%.

In the 2024 Capital Budget, the City of Toronto plans to collect a total of $518 million from Development Charges. This will cover 11% of planned 2024 capital spending (more on that later). The City also often raises more from Development Charges than it plans. For example in 2023, the City planned to raise $505 million, but actually collected $817 million.

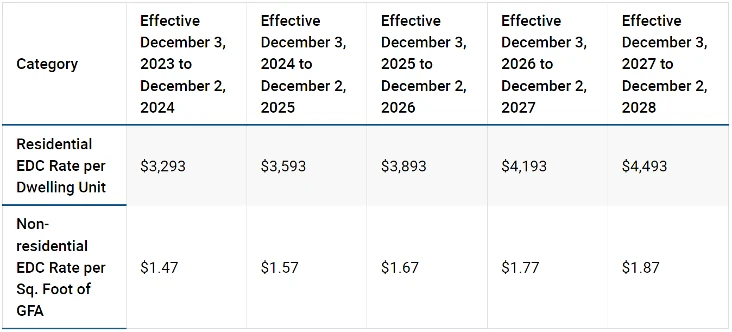

In addition to the base Development Charges collected by the City of Toronto, the Toronto Catholic District School Board also raises Education Development Charges. The rates for 2023 to 2028 are shown in the table below. While these are significantly lower than the Development Charges collected by the City, they too have been rising rapidly.

The Toronto District School Board also wishes to raise Education Development Charges. They are not currently allowed to do so under the regulation, as the TDSB has excess capacity in its schools. Following a failed judicial review, they are lobbying the Ontario government to change the regulations to allow them to raise Education Development Charges.

Who Pays Development Charges?

Development Charges are collected from the developer. They are due at the time the building permit is issued with two exceptions. The first is rental housing, where development charges are collected in six annual installments following first occupancy. The second is laneway houses and garden suites, where development charges can be paid up to 20 years following the issue of the building permit.

Are There Any Exemptions or Reductions?

There are many exemptions to Development Charges, some of which are outlined by provincial law, and some of which are outlined in the City of Toronto’s Bylaw. The main categories of exemptions include:

- School boards,

- Universities and colleges,

- Hospitals and hospices,

- The City of Toronto itself,

- Affordable housing,

- Industrial uses,

- Places of worship,

- New or existing buildings with up to 3 or 4 units (depending on the building type)

There are also development charge refunds available through the City of Toronto for meeting requirements of the Toronto Green Standards program. As an example, in 2024, a one bedroom unit which met the latest requirements in 2024 would be eligible for a refund of $4,353.31

How Do Development Charges Impact New Housing Prices?

Development charges are a type of tax. As with any tax, there is a difference between who the tax is collected from and who ultimately bears the cost of the tax. This is known as tax incidence. Whether the cost mostly falls on the supplier (i.e. the developer) or the consumer (i.e. new home buyers) is an empirical question which depends on what economists call the elasticity of the housing supply and demand.

This isn’t an article about economics, but a 2021 review of the economic literature on Development Charges by the Centre for Urban Policy and Local Governance at Western University concluded that in the GTA, new home buyers are likely bearing most of the cost of Development Charges. They also noted that the increased price for new housing as a result of Development Charges is also likely to increase the cost of existing homes as well.

What Can Development Charges be Used to Fund?

The list of services is outlined in Section 4 of the Development Charges Act. The main categories include transit, water and sewer services, electricity infrastructure, emergency response services, libraries, long-term care facilities, and child care facilities.

Education Development Charges, as the name implies, are used to fund the capital needs of school boards.

Can the City Use Development Charges to Build New Housing?

No. Use of development charges for Housing Services was removed from the Development Charges Act as part of Bill 23.

How Does the City Determine Development Charge Rates?

To determine Development Charges rates, municipalities must estimate what fraction of new infrastructure spending is required as a result of new development, and then what fraction of that spending is eligible for recovery under the Development Charges Act. Toronto’s most recent estimates were prepared in a May 2023 Development Charges Background Study by the consulting firm Hemson.

The study estimated residential and non-residential growth within the City, as well as planned level of transit service and historical costs of providing City services. It then estimated what fraction of the capital expenditures are eligible to be recovered under the Development Charges Act.

The report concluded that $15 billion of the $67 billion dollar capital program from 2022 to 2041 would be eligible for recovery through Development Charges based on a projected population growth of 432,243 people and employment growth of 274,900 jobs. They then calculated the Development Charges rates based on that estimate which the City has implemented.

These types of studies are complex, and estimation of population and cost is notoriously uncertain. This article won’t go through a breakdown of the methodology and modelling and whether they are reasonable. But there are two ways the City used the report that are worth mentioning.

The first is that the residential rates calculated in the Background Report are based on $1.5 billion of affordable housing being eligible for Development Charge cost recovery (17% of the total eligible residential cost). However, as a result of Bill 23 (which was passed in 2022), affordable housing is no longer eligible for cost recovery. The City’s 2024 Development Charges rates are remarkably similar to those calculated in the Background Report, even though the affordable housing component is listed as $0. This suggests that the cost recovery for affordable housing was simply shifted to other categories rather than removed.

The second is that the City is not obligated to recover the maximum amount of costs that are eligible under the Development Charges Act. They chose to set the rates to attempt to recover the maximum amount of capital costs. Given the current price of housing in Toronto, they could have chosen lower rates to avoid further increasing housing prices.

Is the City Using the Development Charges it Raises?

When the City collects Development Charges, it assigns them to a project in the Capital Budget. However, the City of Toronto consistently underspends the Capital Budget, only spending on average 65% of the budgeted amount in a given year. As a result, the allocated Development Charges do not get spent when planned, and pile up waiting for projects to finish. As of June 30, 2024, there was a backlog of $3.2 billion of unspent Development Charges.

Since in addition to spending Development Charges slower than it plans, the City also consistently raises more Development Charges than it plans, this suggests that the current Development Charges rates are higher than the City needs to support existing capital spending.