Published in the Journal of Urban Affairs on February 28, 2020. https://doi.org/10.1080/07352166.2019.1705846

Find a copy of the complete article here: http://www.waterlooregion.org/sites/default/files/August2020.pdf

Summary

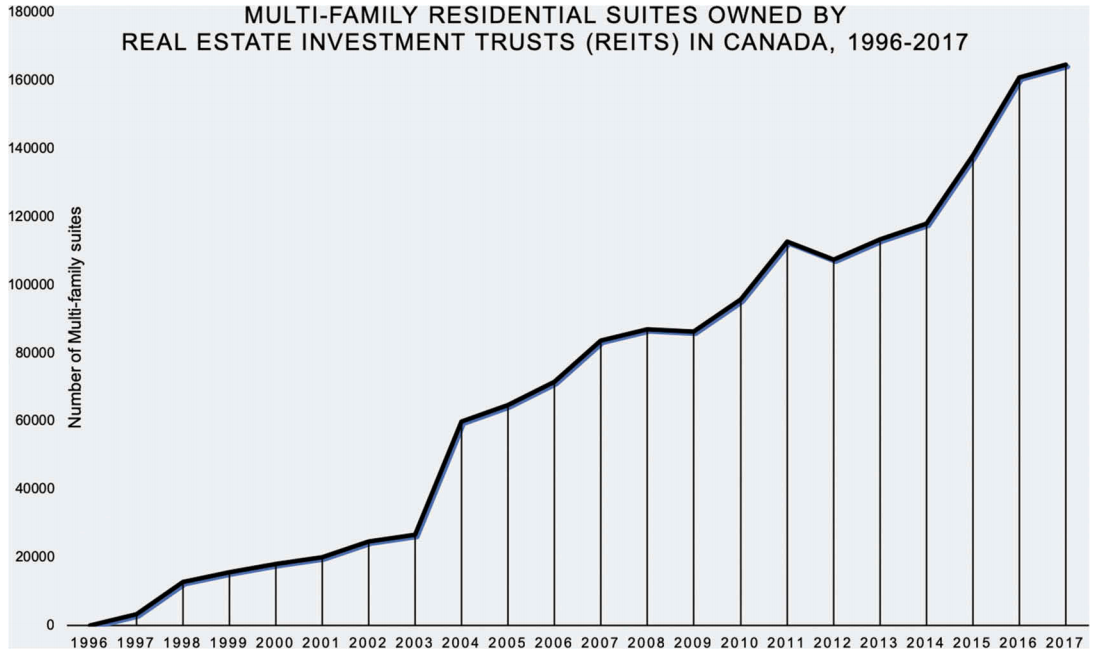

This paper begins by exploring the theoretical and practical relevance of the financialization of multi-family rental housing. I discuss how “financialized” ownership remakes homes into assets, and transforms the sector as a whole into product for investors—creating a new asset class that enriches them via business strategies based on tenant dispossession. The second section launches a nationwide examination of this process in Canada, showing how state policy and other factors produced multi-family housing as a gold mine for reinvestment in the late 1990s, and tracing the history of domestic firms that grew into sophisticated financial platforms. A key contribution is my list of Canada’s biggest landlords, which has not elsewhere been assembled. Third, I examine the crucial role of state policy in creating an uneven landscape of rental regulation, which has lured financial capital to certain provinces and deterred investment in others. Finally, I propose a three-part typology of “geographic-investment” strategies that have allowed financialized landlords to penetrate Canada’s diverse regional housing market geographies. The typology identifies “core,” “value-add,” and “opportunistic” strategies that are used in big cities, smaller towns, and resource-driven markets. This section draws on detailed empirical data on firms, and a novel analysis of their business models, identifying similarities which have important implications for housing justice. In the conclusion, I turn to the apartment suite as a flashpoint for struggle around whether housing ought to be treated as a home or a financial asset.